Using QuickBooks for cost accounting

Q: We are planning to convert our accounting system

to QuickBooks next month, and we plan to use QuickBooks primarily for

job costing. Do you have any recommendations related to our setup that

we should consider?

Q: We are planning to convert our accounting system

to QuickBooks next month, and we plan to use QuickBooks primarily for

job costing. Do you have any recommendations related to our setup that

we should consider?

A: You are asking the right question at the right time. I sometimes find that companies using QuickBooks job costing do not obtain the results they desire because the default job-cost preferences were not set up correctly.

So that your implementation of QuickBooks provides all of the job-costing capabilities and functionality QuickBooks has to offer, activate the following eight QuickBooks preferences:

1. Estimates. Enable estimates from the QuickBooks

menu by selecting the Edit,

Preferences, Jobs & Estimates,

Company Preferences tab, and then select the radio

button labeled Yes in the Do You Create

Estimates? box. This setting will enable you to link

estimates to your jobs.

1. Estimates. Enable estimates from the QuickBooks

menu by selecting the Edit,

Preferences, Jobs & Estimates,

Company Preferences tab, and then select the radio

button labeled Yes in the Do You Create

Estimates? box. This setting will enable you to link

estimates to your jobs.

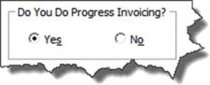

2. Progress Invoicing. Enable Progress Invoicing by selecting the Edit, Preferences, Jobs & Estimates, Company Preferences tab, and then select the radio button labeled Yes from the Do You Do Progress Invoicing? box. This setting will enable you to invoice part of a job based on either the job completion percentage or the completion percentage applied to each line item in the estimate.

3. Inventory warning. Enable a warning to display when there is not enough inventory to sell based on what’s available. To do this, select the Edit, Preferences, Items & Inventory, Company Preferences tab, then check the box labeled Warn if not enough inventory to sell and select the radio button labeled Quantity Available. This setting will create an alert when you create an estimate that includes goods not on hand so you can quote the customer a more accurate delivery time along with your estimate.

4. ? This setting will allow timesheet users to record their actual time

against jobs.

This setting will allow timesheet users to record their actual time

against jobs.

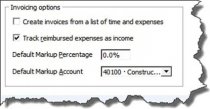

5. Create invoices from time and expenses. If you invoice using the time and material billing method, select the Edit, Preferences, Time & Expenses, Company Preferences tab, then check the box labeled Create invoices from a list of time and expenses. This setting reminds the invoice preparer that time or reimbursable expenses related to the job exist, and provides an easy method for including those costs on the invoice.

6. Reimbursable expenses. From the same tab, you can enable the reimbursed expense option by checking the box labeled Track reimbursed expenses as income. This setting will enable you to more easily post out-of-pocket job expenses (such as meals or travel) to your jobs for reimbursement purposes.

Related posts:

If you already have a PC and are looking to convert it to a full POS System, a bundled POS Kit is a fantastic option. Having a POS System at your business can…

If you already have a PC and are looking to convert it to a full POS System, a bundled POS Kit is a fantastic option. Having a POS System at your business can… Most of this is the Aloha default setup.NETWORK SETUP workgroup = ibertech servername = alohaboh Static IP Scheme ex 192.168.1.100 NetBIOS must be enabled over…

Most of this is the Aloha default setup.NETWORK SETUP workgroup = ibertech servername = alohaboh Static IP Scheme ex 192.168.1.100 NetBIOS must be enabled over… *Receive the stated discounted price for this year’s version of the product selected, available for a limited time if purchased through Intuit. Free shipping…

*Receive the stated discounted price for this year’s version of the product selected, available for a limited time if purchased through Intuit. Free shipping… Join millions of philatelists (or stamp collectors) in collecting, displaying and enjoying Canadian stamps. We take pride in producing beautiful and…

Join millions of philatelists (or stamp collectors) in collecting, displaying and enjoying Canadian stamps. We take pride in producing beautiful and… Allentown, PA-based point-of-sale (POS) vendor Harbortouch has disclosed a data breach affecting “a small number” of merchants using its systems. Brian Krebs,…

Allentown, PA-based point-of-sale (POS) vendor Harbortouch has disclosed a data breach affecting “a small number” of merchants using its systems. Brian Krebs,… Trust is the reason new businesses open accounts with us. Trust is the reason clients stay with us. And trust is the reason they refer their colleagues to us.…

Trust is the reason new businesses open accounts with us. Trust is the reason clients stay with us. And trust is the reason they refer their colleagues to us.…